/ Academics / Departments & Programs / Business / Academics / Business Minor

Business Minor

minor

Degree Overview

Take the next step:

Be part of a global economy

The world has never been more interconnected than it is today. A business degree supported by a global studies minor can open up all kinds of opportunities. Learn more »

Pack your bags

Get ready for an education that’s truly global. Calvin’s business curriculum can take you to places like Kenya, Hungary, South Korea, India, and China. Or, stay stateside with an internship through Chicago Semester. The hardest part? Picking the adventure for you. Explore off-campus programs »

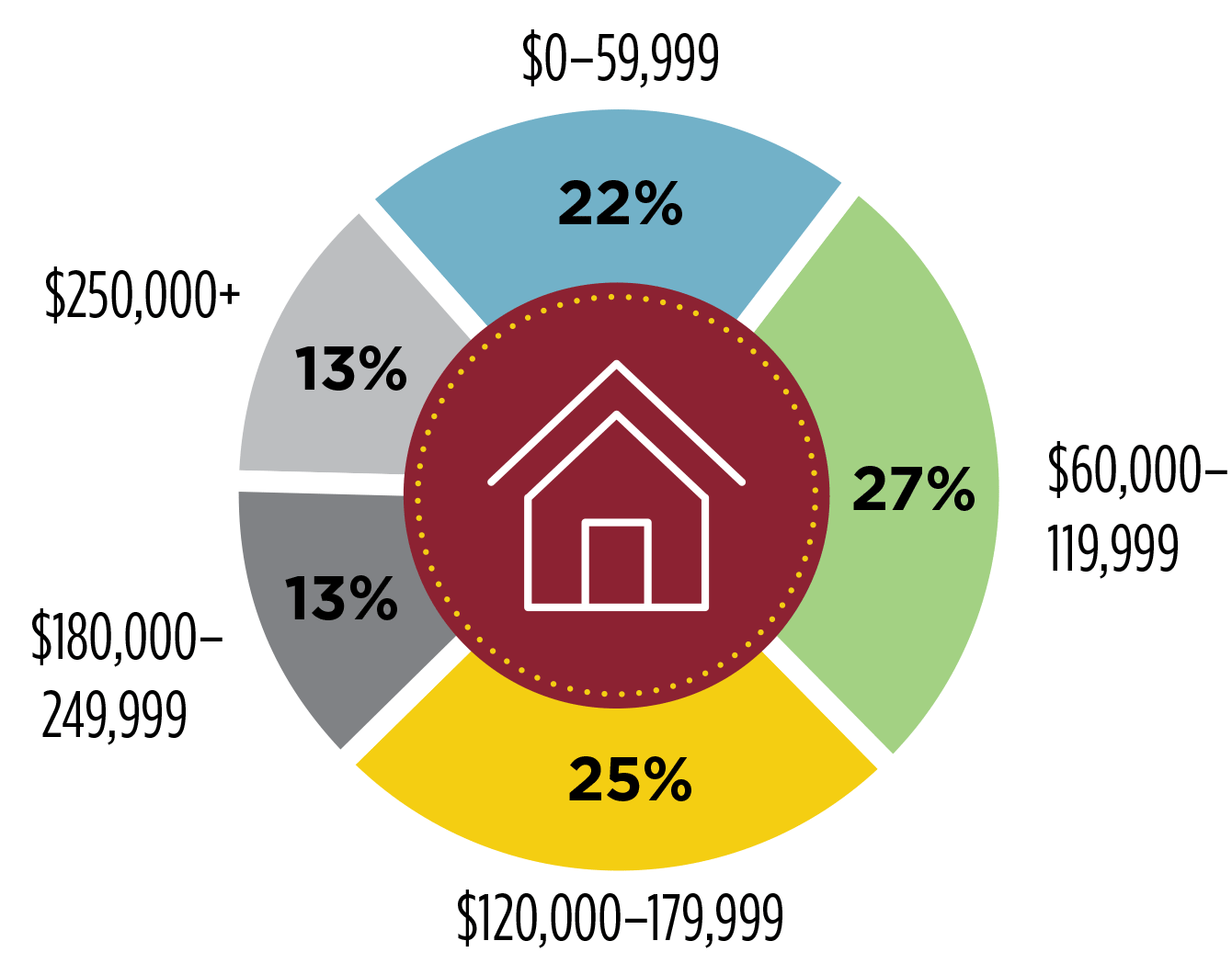

Family income distribution for students applying for financial aid.

You can afford a Calvin education.

You’ve heard a lot about the high cost of a university education. But a Calvin education is much more affordable than you think. Most Calvin students pay far below the sticker price—and graduate with less debt than you might expect.

A reputation for excellence.

There’s a reason Calvin gets top marks from U.S. News & World Report, The Princeton Review, and more. Calvin graduates are in demand at grad schools, med schools, and careers in every field.

ACADEMIC OPTIONS

With over 100 majors and programs, you’re bound to find something you love.

Browse by category

- Arts

- Business

- Communication & Media Studies

- Education

Undergraduate education

- Birth to Kindergarten

- Pre-Kindergarten to 3rd Grade

- 3rd to 6th Grade

- Art: Pre-K to 12th Grade

- French: Pre-K to 12th Grade

- Health & PE: Pre-K to 12th Grade

- Spanish: Pre-K to 12th Grade

- Special Education Pre-K to 12th Grade

- TESOL: Pre-K to 12th Grade

- Secondary Education

- English: 5th to 9th Grade

- Math: 5th to 9th Grade

- Science: 5th to 9th Grade

- Social Studies: 5th to 9th Grade

- English: 7th to 12th Grade

- Math: 7th to 12th Grade

- Science: 7th to 12th Grade

- Social Studies: 7th to 12th Grade

- Health Sciences

- Exercise Science

- Kinesiology (Pre-professional Emphasis)

- Nursing

- One Health

- Pre-Dentistry

- Pre-Medicine

- Pre-Occupational Therapy

- Pre-Optometry

- Pre-Pharmacy

- Pre-Physical Therapy

- Pre-Physician Assistant

- Pre-Podiatry

- Pre-Veterinary

- Public Health

- Recreation Leadership

- Speech Pathology and Audiology (BA, MA)

- Master of Speech Pathology

- Theraputic Recreation

- Humanities

- Ministry

- Science, Technology, Engineering & Mathematics

- Social Sciences

- World Languages & Cultural Studies

Apply to Calvin

It all starts here! We accept applications on a rolling basis throughout the year. All completed applications receive equal consideration.

Start your journey

Visit Calvin

Find the visit option that works best for you and get a taste for life at Calvin!

Browse Visit Options Launch the virtual tour

Request Info

Learn why Calvin’s dedication to faith and discovery have earned it the rank of #3 among regional Midwest universities.

Costs & Financial Aid

Families from all economic backgrounds—many just like yours—are making Calvin work. Scholarships, grants and loans are the tools that make Calvin possible.

Explore financial aid & Scholarships How much does Calvin cost?