Local elections don’t usually measure up to the high drama we’re used to from last November, but they make a great deal of difference by determining the nitty-gritty of how money is spent in communities, and that can have a huge impact.

Voters in Kent County approved a new property tax on May 2 that will secure funding for the Kent Intermediate School District (Kent ISD) with a sum of $19 million each year for the next ten years.

However, low voter turnout also plagued the Tuesday vote, with overall turnout in the county at 17 percent. The city of Grand Rapids had a turnout of about 12 percent, with around 16,000 total ballots cast.

The tax places a new 0.9 millage on taxable property in the school district. This means that a home valued at $150,000, or $75,000 in taxable value, will have an additional $67.50 a year in taxes.

The tax will result in $211 per student per year in the Kent ISD, which will be allocated to schools on a per-student basis. The money will go towards the school’s operating costs, which The Grand Rapids Press reported may include working to reduce class sizes, hiring new counselors and literacy instructors, and funding new college prep and career programs.

School officials say that state funding has lost pace with the rate of inflation since 2008, which has caused serious underfunding of public schools in the area.

“We are thankful that our voters understand the financial pressures local districts have been operating under and provided these additional resources for learning opportunities for the children of our county,” said Kent ISD superintendent Ron Caniff in an interview with the Grand Rapids Press.

In the district-wide vote, 39,996, or 53.9 percent, voted yes on the millage and 34,193, or 46.1 percent, voted no. The portions of Barry County and Ottawa County that fall inside the Kent ISD rejected the millage, as did the cities of Cedar Springs and Walker, and Nelson, Solon and Sparta townships in the north of the county.

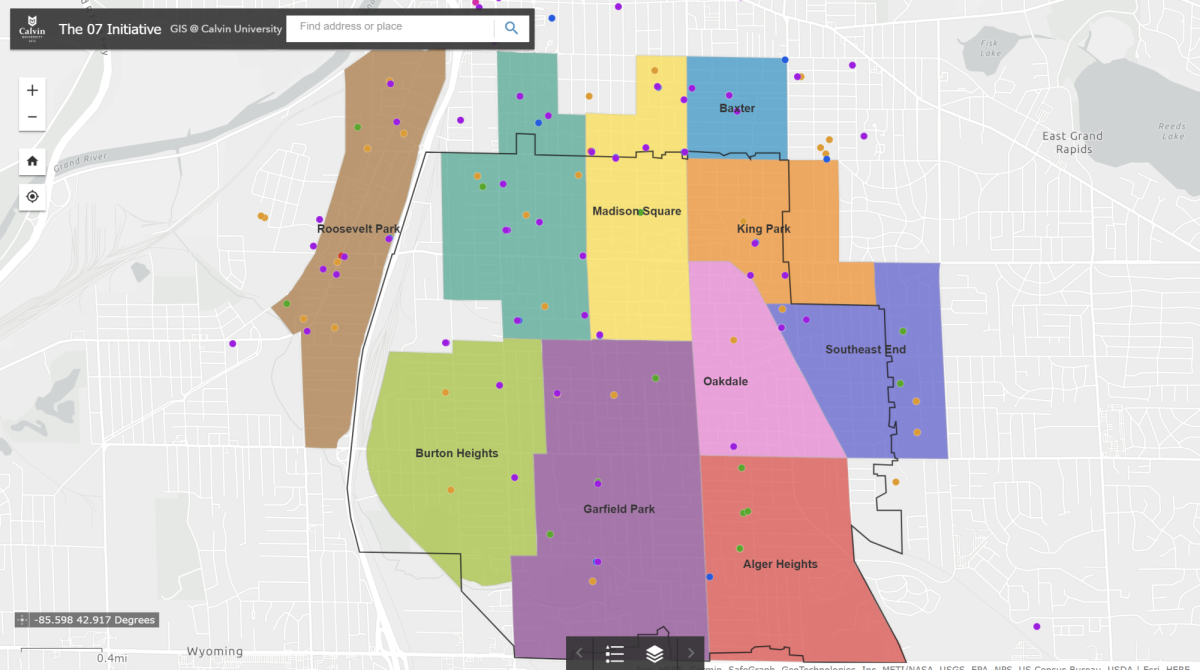

In the city of Grand Rapids, precincts on the west and north outskirts of the city voted no on the millage, whereas the city center and the southeast side, which contains Calvin College, voted yes almost exclusively. Some districts had voter turnout as low as 1.84 percent, like precinct 15, which is a predominantly Hispanic neighborhood on the southwest side, which had just 36 votes (26 yes, 10 no).

The outer precincts which rejected the measure are demographically predominantly white precincts, besides the southernmost precinct in Grand Rapids, which is located in a highly diverse neighborhood with a large immigrant population.

The low voter turnout was expected, but Wood TV 8 reports a correlation between high voter turnout and “yes” votes that suggests voter turnout is crucial in determining local elections like this one.

Several groups that opposed the millage include the Kent County Taxpayers Alliance (KCTA) and Kent Education Action. KCTA argued on its website that the county’s public schools “have not done an adequate job controlling costs at the administrative level” and Kent Education Action reportedly sent out texts and robocalls that said money from the millage would feed the “exploding pay of superintendents in Kent County school districts” and that money would most likely be sent out of one’s district because the funds were to be allotted based on the number of students at a school.

Other measures that passed in Kent County include allowing the Wyoming library millage funds to go to public parks in the city, a bonding proposal for the Byron Center Public Schools, and a recreation and trails millage for Cannon Township. All three of these measures passed.