Mt. Gox, a prominent Japanese bitcoin exchange, ceased transactions and shuttered its website Monday. The shutdown comes after a leaked document revealed massive theft resulting in the exchange’s insolvency.

Mt. Gox began in 2009 as Magic: The Gathering Online Exchange, a website for exchanging trading cards. The original owner changed the focus of the website in 2011 to a bitcoin currency exchange, selling it to current CEO Mark Karpeles. Mt. Gox handled 70 percent of all bitcoin trades in April 2013.

On Feb. 7, Mt. Gox suspended bitcoin withdrawals. A press release stated that the exchange had detected “unusual activity” related to “transaction malleability.” “A bug in the bitcoin software makes it possible for someone to use the bitcoin network to alter transaction details to make it seem like a sending of bitcoins to a bitcoin wallet did not occur when in fact it did occur,” explains the release. “Since the transaction appears as if it has not proceeded correctly, the bitcoins may be present.”

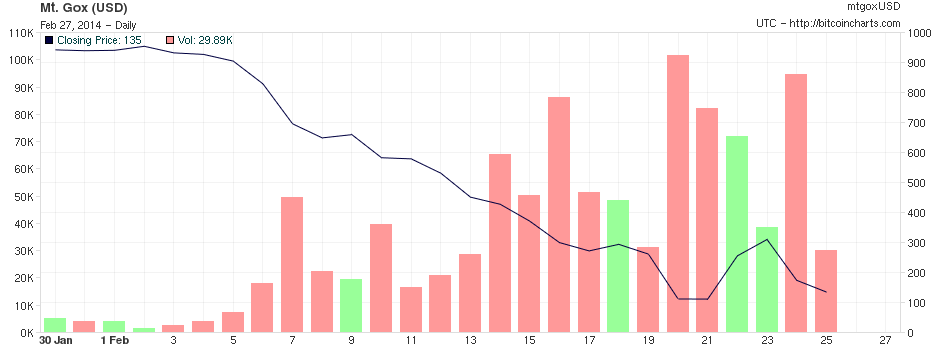

The price of bitcoin on Mt. Gox, which closed as high as $1,007 on Jan. 26, fell to $111 by Feb. 20, according to bitcoincharts.com.

Mt. Gox resigned Sunday from the Bitcoin Foundation, an industry advocacy group of which it was a founding member.

On the evening of Monday, Feb. 24, Ryan Selkis blogged about a report leaked to him from a “reliable source.” The report, titled “Crisis Strategy Draft,” revealed losses of 744,408 bitcoin, worth approximately $350 million based on exchange rates for Monday. The report blames the losses on theft enabled by the transaction malleability issue “which went unnoticed for several years.” Several hours later, he leaked the report. Shortly thereafter, Mt. Gox halted trading.

In response, industry leaders issued a joint statement denouncing mismanagement at Mt. Gox. “In order to re-establish the trust squandered by the failings of Mt. Gox,” read the statement posted at the Coinbase blog, “responsible bitcoin exchanges are working together and are committed to the future of bitcoin and the security of all customer funds.” The statement called for increased responsibility and transparency in order to maintain consumer confidence in the cryptocurrency.

Soon after the report, mtgox.com was taken offline. The website later reappeared as a landing page with a message to Mt. Gox customers: “In light of recent news reports and the potential repercussions on Mt. Gox’s operations and the market, a decision was taken to close all transactions for the time being in order to protect the site and our users. We will be closely monitoring the situation and will react accordingly.”

The leaked document, which Karpeles confirmed as being “more or less legit,” acknowledged the damage that the revelation would cause to the public perception not only of Mt. Gox, but also of bitcoin as a whole, among other cryptocurrencies. The document highlighted a plan to rebrand Mt. Gox as Gox. Mt. Gox’s parent company recently purchased the domain gox.com, which currently redirects to mtgox.com.

“Regardless of malleability and regulatory issues, Mt. Gox’s main problems are massive robbery and poor bitcoin accounting,” stated the report.

The average price of bitcoin fell from $612 on Sunday to $540 on Monday, according to Coinbase. The price of bitcoin has fluctuated wildly in the past several months, trading as high as $1,100 in late November 2013.

Mt. Gox faces investigations by authorities in Japan and the United States.