Calvin is facing a 10 percent budget shortfall that must be accounted for in the next five years.

Newly-inaugurated president Michael Le Roy learned the full details of the projected problem when he began going through Calvin’s budget shortly after starting his position on July 1. “I wanted to really understand where we were,” he said in an interview with Chimes. Le Roy cited three reasons for wanting to get the whole story of Calvin’s financial situation.

First, colleges in the Midwest are facing bleaker enrollment numbers in the future. “In the Midwest, enrollment figures look flat over the next 10 years or so,” said Le Roy. Fewer students means less revenue and tighter budgets for colleges.

Second, the entire country is recovering from a major recession. Finances are tight everywhere, particularly in higher education. Most colleges, including Calvin, have already done some minor restructuring to account for this, but there is still more to be done.

Third, when Le Roy looked at the forecast for Calvin’s future (the next five to seven years), he saw costs piling up, and didn’t want to pass those costs on to students. “I viewed it as my responsibility coming in to make sure Calvin is affordable and sustainable for the long run,” he said.

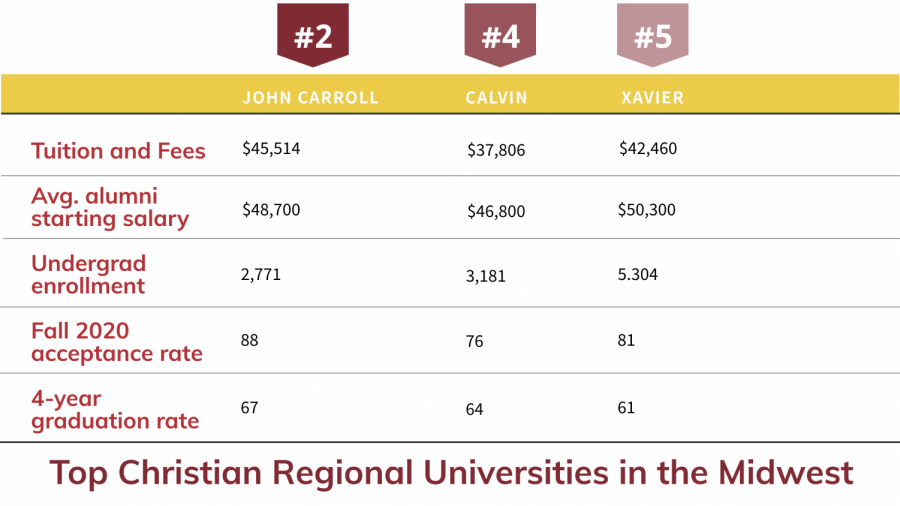

These cost increases are coming from a rise in the cost of healthcare for employees, keeping technology up to date and keeping faculty salaries competitive with Calvin’s peer institutions.

Aside from rising costs, Calvin is also facing significant debt payments starting around five years from now as a result of its use of debt financing. Debt financing allowed the college to earn investment return on money donated towards building projects. Calvin borrowed the money to construct buildings like the Fieldhouse, and invested the unused borrowed funds and incoming donations. The expectation was that the investment would make more money than the debt cost to service.

This strategy was successful until the stock market crash in 2008. The crash especially hurt Calvin because several large debt-financed building projects, like the Fieldhouse, were begun not long before it. Since 1997, Calvin has spent $32 million more in debt service payments than the yield on related investments. Large market losses in 2008-09 are the main cause.

After looking over all of these factors and trying to project how the college would deal with both its expenses and debt, Le Roy realized that Calvin wasn’t prepared. To address this situation, the college needs to be ready to make a few cuts and restructure its programs and services in order to make room for the additional 10 percent, which, based on Calvin’s current budget of $103 million, is $10.3 million.

Many have asked how this projected gap came about. $10.3 million is a significant amount — one it seems hard to imagine was simply overlooked in past years.

When explaining how the problem avoided full analysis, Le Roy and Doug Koopman, executive associate for communication and planning, used the analogy of a jigsaw puzzle.

“All the pieces were face up on the table,” said Koopman, “but no one had put them together.”

Le Roy echoed the analogy, noting that too many different people were in charge of overseeing different parts of the budget. And, he noted, no one was talking about it.

“I noticed there wasn’t a culture here of lots of faculty and staff looking at finances and asking questions,” he said. This was in contrast to his previous job as provost of Whitworth University, where many in the community would read budget reports closely and ask questions.

This lack of communication and transparency in financial matters combined with the increasingly complex landscape of higher education, created a perfect storm for unforeseen costs to arise.

This is not to say that Le Roy thinks past administrators were negligent. “I try to be charitable to those who were in the decision making chair five years ago,” he said. As a college administrator during the financial crash, he noted it surprised him as much as anyone else.

Calvin is using this potential crisis as further impetus to focus its future and mission. 2013 is the last year of Calvin’s current strategic plan, “How Will This Promote Learning” (HWTPL*). The college is starting the cycle of producing a new strategic plan for the next five years.

The process of strategic planning will have two parts. The first is a prioritization of all the programs and services Calvin offers, to determine what is important to the college and demands more investment, and what the college can do without to partially make up the budget shortfall.

Le Roy was quick to point out that the changes will in no way affect students’ studies. “If you came to study primate psychology, and we decide we’re not going to do that anymore,” he said, “we’re going to teach it 3 or 4 more years.”

Ten percent of the budget is a significant amount, so making up the difference will mean some visible changes.

“We’re not going to cut 20 programs,” Le Roy assured, “but there will be significant changes.”

The college is planning to use a bottom-up method for the prioritization process. Beginning after Christmas, Calvin will hold a series of public forums where all community members can make their voices heard. Then, each department and program chair will be asked to look at her group’s structure and costs and make a recommendation to the newly-restructured Planning and Priorities Committee about which programs should have priority.

“It will be a very open process, and everyone will know what the criteria are,” said Le Roy.

Le Roy also hopes to get students engaged in the process, letting the college know what’s important and what’s not. “When we look through the eyes of students,” he said, “We see what’s really important.”

Especially under scrutiny will be the investments into unrelated businesses and real estate that Calvin has made. Calvin currently owns real estate such as Weyhill Properties, the Ladies Literary Club and the Glen Oaks East apartment complex, besides the campus itself. Investments were made into these properties as part of the broader strategy of diversifying assets. The strategic planning process will scrutinize whether these side projects are a distraction to the college’s educational mission.

Koopman explained that the trend in higher education is a move from diversification to specialization. At one time, it was conventional wisdom for higher education institutions to diversify their assets and invest in many different, sometimes unrelated, ventures. But in a time when everyone’s pocketbooks are getting thinner, higher education, and Calvin with it, hopes to create a tighter focus on core mission; that is, educating students.

Bain & Company’s report, “The Financially Sustainable University,” which Koopman keeps at hand, explains why this makes sense. “The healthiest organizations — from Fortune 500 companies to start-ups to academic institutions — operate with a discipline that allows them to stay true to their core business,” it states. “The core is where high-performing institutions invest the most and generate the greatest returns.”

The second part of the strategic planning process is envisioning what the college can look like through the future.

Much discussion will occur in the coming months, and Le Roy has one request: “The one thing I’m going to ask everyone to do is: let’s try hard to trust this process.” He added, “Everything I do here is with an eye toward ‘How do we come out of this stronger?’”

Ultimately, Le Roy is optimistic about the changes in store for Calvin.

“Money problems are the easiest to solve,” he said, noting that things like losing accreditation, natural disaster, or losing sight of an institution’s mission are all things that “take a generation or two to fix.”

He sees the tough situation as a teaching moment. “It’s times like these that teach us about trusting God,” he says. Calvin’s is “such a strong story of faithfulness. I can’t help but think that will continue.”

“This has led me to feel even more committed to this place,” he said.

Please see this week’s editorial for another perspective on this story.