Top actions

Connect

Stay connected with alumni and the university! Join our virtual book club, find fellow alums in our directory, or follow us on one of our various social media platforms to stay informed!

Alumni Benefits & Services

Wherever life takes you, Calvin University continues to be an important piece of your journey. Discover the many ways the alumni association and the university provide lifelong benefits and services to you. Stay connected and feel the support of a vibrant Calvin Nation!

Spark Magazine

The official Calvin alumni magazine, featuring stories about Knights across the globe. Also find forms to change your address, submit news, and obituaries.

Get the latest

-

Knight Investment Management alumni dinner

6:30 PM, Wed, April 24, 2024

Prince Conference Center Great Hall -

Grad Celebration

5:00 PM, Fri, April 26, 2024

Hoogenboom Gym -

50-Year Reunion: Class of 1974

12:00 AM, Fri, May 3, 2024 -

Heritage Network Spring Lecture

3:00 PM, Wed, May 8, 2024

Covenant Fine Arts Center Recital Hall -

Alumni gathering in the Netherlands

6:00 PM, Wed, May 15, 2024 -

"Wicked" with Broadway GR!

7:30 PM, Wed, May 15, 2024

Off Campus -

CAA/CALL Travel: Rhine River Cruise (full)

12:00 AM, Tue, May 21, 2024 -

CAA/CALL Travel: The Wilds of Alaska (full)

12:00 AM, Mon, June 10, 2024

-

Calvin Remembers Edna Greenway

On January 9, 2024, Edna Greenway died at the age of 88. When asked for words to describe Greenway, former colleagues and students at Calvin most often expressed "faithful" and "encourager." News & Stories, January 23, 2024 -

Sidney J. Jansma Jr. awarded 2024 Kuyper Prize

Sid Jansma Jr. will be the recipient of the 2024 Kuyper Prize, which is awarded annually by Calvin University and Calvin Theological Seminary. News & Stories, December 12, 2023 -

Opening a pathway to deepen ASL learning

For her senior project, Nikita Sietsema worked with two computer science colleagues to create a website that helps students studying American Sign Language to nail down vocabulary. News & Stories, December 4, 2023 -

Inspired to Go Beyond Limited Expectations

Rob Woods and Adam Dupuis entered prison at the same time and for the same crime. After a twenty-plus year journey inside prisons across the state, they reunited through the Calvin Prison Initiative program. News & Stories, November 21, 2023 -

Calvin grad named National History Teacher of the Year

Matt Vriesman became hooked on history at Calvin. For the past 15 years, he's helping high school students get hooked too. In 2023, The Gilder Lehrman Institute of American History is honoring him as its National History Teacher of the Year. News & Stories, October 17, 2023 -

Calvin University announces 2024 January Series lineup

The 2024 edition of Calvin University’s award-winning January Series features national podcasters and journalists, a world-renowned rock climber, French-American jazz pianist and composer, an American legal scholar, and a Pulitzer Prize-winning author. News & Stories, October 10, 2023 -

Calvin University hosts Homecoming & Family Weekend

On Friday, September 29 and Saturday, September 30, Calvin University welcomes alumni, family, and the broader community to campus for Homecoming & Family Weekend. News & Stories, September 28, 2023 -

U.S. News & World Report ranks Calvin near the top of multiple lists

Calvin University ranks fourth overall among all Midwest regional universities featured in U.S. News & World Report's 2024 Best Colleges Guidebook. The university also received high marks for undergraduate teaching, merit-based aid awarding, international student enrollment, and first-year retention. News & Stories, September 18, 2023 -

Ralph Luimes ’83

Outstanding Service Award

Spark, Fall 2015 -

Ken Piers

Faith and Learning Award

Spark, Fall 2015 -

Class of ’65 presents a thoughtful weekend

Litany, personal stories stir emotions

Spark, Fall 2015 -

Calvin celebrates 900 graduates

Young alums challenged to be catalysts, one day at a time

Spark, Fall 2015 -

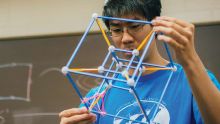

A gold standard for STEM research

Calvin a leader in Goldwater scholars

Spark, Fall 2015 -

C Club recognizes Veenstra, celebrates Commissioner’s Cup

Spark, Fall 2015 -

A Plan to Engage the World

Calvin drafting new master plan with an outward, welcoming focus

Spark, Spring 2015 -

Socks that make a statement

Ryan Roff ‘09

Spark, Summer 2014